Where I've Been Sharing

I haven't been posting much on this blog for a while, which is pretty obvious if you look back at the posts. Instead, I have been sharing ideas on the blog site

SeekingAlpha.com.

Some of my ideas are in the following articles (listed at the bottom of this page) that are available on Seeking Alpha. I have published roughly 50 articles there as of this writing. While my articles cover a broad spectrum of sectors, I have focused lately on the REIT field. That could change, however.

My Current Thinking (February 2015)

I am focusing on REIT stocks right now, which is somewhat against the current 'common wisdom.' My thinking is that during volatile times, the best refuge is an income stock which provides a strong, sustainable dividend. Should the market have problems and such a stock sink, you will have a consistent tool for lowering your basis over time by reinvesting the dividends. The primary danger is a sudden rise in interest rates, but a gradual rise in rates should not do income stocks much damage. It is the type of rate increases that matter, not just the fact that there are interest rate increases.

Plus, I simply like the compounding effect of reinvesting dividends. So, income stocks work for me during good times, too.

|

| Snapshot in time: 21 February 2015 |

At the present time (February 2015), with rates at extreme lows, there is no question that at some point the Fed will increase interest rates. However, with the strong dollar and weakening economies overseas, there are definite limits on how far US interest rates can rise before capital inflows and a deleterious effect on the trade balance cause that to become a dangerous strategy. I currently do not expect a rate hike in 2015 ("

The Case for Reits in 2015 "). However, that will be determined by events.

Why I Like Certain Income Stocks

I have been writing mostly about REITS lately. That label is somewhat deceptive: REITs display a huge amount of variety, and the label is more descriptive of their organizational structure for tax purposes than an indication of what they actually do. The fact that many REITs don't even own any real estate (or minimal real estate as an adjunct to their main business) should tell you all you need to know about that.

As a general matter, and take this for what it is worth, I believe that real estate has been and remains the best way for the ordinary person to accumulate wealth over time without extraordinary luck, wisdom or connections - though the wisdom part does help. It worked for me.

However, it is customary to aggregate REITs together, so I will, too. I like REITs for two reasons: I love the pass-through structure (I like BDCs and utilities for the same reason), and I also like a focus on real estate (though not necessarily exclusively). I would rather receive the majority of the income that a) a company manages to earn rather than b) have someone with who knows what ethics and/or agenda at the company decide what to do with it, and c) have that income subject to the double taxation of corporate taxes on it to boot, and then d) have the market decide if those people within the company have done a good job. Too many places in that stream for something to go wrong, and I have a very dim view of the supposed 'wisdom' of the market.

|

| Snapshot in time: 26 April 2015 |

In other words: Just give

me the money. I'll decide whether the company is doing a good job with my money and perhaps reward the managers by giving it back the capital (through reinvestment) rather than rely on the market, with all its momentary passions, booms and busts. I admit that I am a bit sour on stocks that do not pay dividends. Too often, you can sit with a stock for ages, build up equity - and then see it all gone because Russia invaded the Crimea, some officer committed fraud or some other extraneous factor that is completely out of your control and/or contemplation. At least you have built up your share count through reinvestment and perhaps taken some off the table along the way with a dividend.

An Investing Trick That I Use

Since you have made it this far and must like something about my work to even be here in the first place, I want to reward you with an investing trick that I have used over and over to great effect. At some point, I will publicize this elsewhere, but here it is. It has worked for me and is extremely easy and simple. No, I have not re-invented the wheel, do not fancy myself to be Warren Buffet, and do not purport to be the last word in anything like Elon Musk. This is a money management technique that I think all income stock investors could benefit from at some point, and is based on years of trading experience. Either use it or disregard it as you see fit. I have all sorts of other techniques that I use surrounding dividends, but I will leave those for another day.

I will own a dividend stock for a while, and after I have collected the dividends over a few cycles, I will look for an opportunity to sell the stock and take whatever profits I have achieved

without the accumulated dividends. Thus, say I buy XYZ for $50 in February, and collect a couple of dividends. In October, I may look for an exit point anywhere north of $50. However, and this is the critical part, I will

only sell the original stake.

|

| My article on MORL reached the top of the SA "Top Articles (most read)" list. |

Thus, I will leave a trail of breadcrumbs behind me. If you choose the right income stocks and reinvest the dividends, you can accumulate a nice little seed for future growth just from the dividend. Take your original stake and put it to work elsewhere to create a new seedling - and

leave the accumulated shares acquired through reinvestment alone.

There are practical considerations here, and the primary one is transaction costs. You will incur an additional fee for selling the reinvested shares some day. There is a way around this - you can do another trade eventually with your main capital in that position and 'scoop up' the original reinvested shares without incurring any additional transaction costs.

|

Snapshot: June 3, 2015

|

A secondary consideration is tax consequences. Having a lot of small positions can be a trial at tax time. However, most brokerages will help you out by allowing you to import your tax information to your software package. In any event, I only go hog wild on this strategy in my tax-advantaged accounts, though I do practice it with a bit less tenacity in my taxable accounts.

A tertiary consideration is size. You do need to have positions of a certain size for this to make sense. However, even if you are trading 1000 shares, this strategy will help you to accumulate a diverse, income-producing portfolio over time that may surprise you. It will be self-sustaining and on automatic pilot as you choose to do other things and enjoy your life.

If someone were to hand you, say, $15 every three months for the rest of your life - is that something you would reject as being not worth reaching out your hand and putting it in your pocket? And that $15 will become $20, $30, $50 if you invest wisely, reinvest your dividends and have a modicum of luck. And then you will have two such positions, then four, then six - your only constraint is time and your skill at picking the right times to open each position and the stocks that you chose - just like with anything else in the market. As with any other stock, you could get unlucky and see your position drop due to a 'taper tantrum' or an interest rate increase or any of a hundred other influences outside your control. However, income stocks are much less volatile than most other stocks (as a general matter), so that reduces your risk to your principal right off the bat - though nothing can eliminate risk completely if you want to gain worthwhile returns in the market.

|

| Snapshot: 9 July 2015 |

This tactic likely will reduce volatility in your account and provide you with 'free' and diverse income streams that accumulate over time. I did this with my Banco Santander stock - selling my original stake and just keeping the reinvested shares - and it worked wonders when the bank made some changes to the dividend and the shares dropped by about 25%. I wound up only seeing a paper loss on the shares from the original reinvested dividends, my original principal was long gone. I can live with that.

Incidentally, I am in the middle of one such play as I type this. It is nearing its end phase, I have accumulated four good-sized dividends and the share price is higher than when I bought the original position. I will not mention the name of the stock because I am not trying to sell you anything or benefit in any way from this. That's just the way it is. I mention this only to illustrate the ability of this strategy to work, believe it or disregard it as you so choose. I intend to sell the initial position some time this year (probably this summer) and then move on to the next play, with the reinvested shares added to my collection of 'free' shares from other such plays.

The shares from each such play have many similarities (they all pay a healthy dividend, for instance), but they also provide a degree of diversification. If a thief at some company commits fraud, or a particular stock's sector gets downgraded, those shares will be damaged for sure - but not the others. I prefer in these cases to pick individual stocks and not just index ETFs or funds because I am going for a higher-than-mediocre return. However, I don't turn my nose up at index funds either and have pursued this strategy with those types of securities, too. The main problem with the index funds is that there are only so many good index ETFs/funds to practice this on, and adding diversification upon diversification upon diversification gets pointless after a while when you are only dealing with a certain defined area (decent dividend payers) of the market anyway.

|

| 100 articles, 16 October 2015 |

In general, dividends give you flexibility, and I take advantage of it. That more than makes up for some studies that purport to prove that dividend stocks perform slightly worse than others.

The Very Best Strategy of All

This will sound a bit odd coming from someone who analyzes the market and actively trades stocks, but the best way to make money in the stock market is to do as little as possible. I don't even think that is open to much debate.

|

| Snapshot 17 October 2015 - 1400 Followers. |

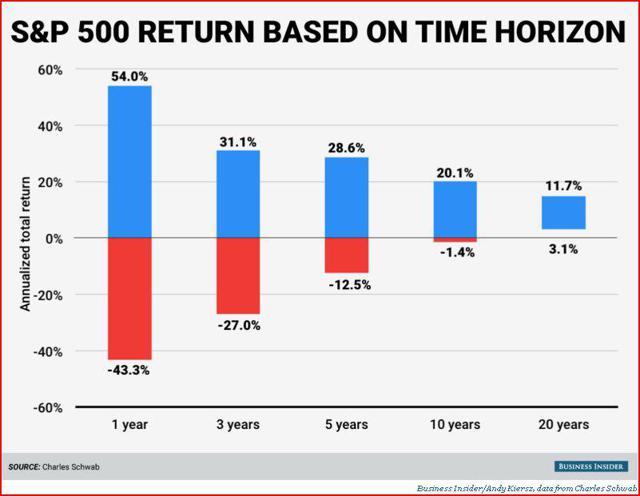

Jeremy Siegel's 2005 book "The Future for Investors" explains that years of stock performance have shown that buying solid companies and doing as little trading of them as possible produces the largest returns over time. On the other hand, trying to time the market or move in and out of different stocks by picking those with the best prospects or size produces the worst returns. His research is based on analysis of the S&P 500. S&P has teams of analysts to pick the stocks with the best prospects, but even that outfit's highly rigorous and fact-based approach tends to cherry-pick companies that are too 'hot' and ripe for a fall.

Naturally, everyone on the Internet will tell you of their fantastic returns buying this stock or that stock, trading in and out of this or that, buying some stock that has incredible recent performance at its recent lows or the 2009 lows and so forth and so on. They aren't all liars or shall we say 'exaggerators,' but the ordinary investors that do most of the talking about stocks on the Internet are those who do have some boasting to do and want some applause for their canny judgment. You won't hear them talk a lot about their losers, or hear at all from many others who have experienced failure (unless they are calling in to some business-oriented chat show to bemoan their situation and get a shoulder to cry on). It's a simple fact of life, basic human psychology. No doubt, many investors get lucky every day and latch on to stocks that do very well for them. That doesn't happen for everyone by a long shot. You also can get a string of 7s or 21s in Vegas despite not knowing what you are doing. There will always be winners, and always be a few big winners, it is a numbers game. Same for losers.

|

| 1000 followers 14 September 2015. Big day. |

Always go with the facts. There will always be exceptions to any rule, for the sake of your own financial health, ignore them. The research shows that, over all, you will do better over time just buying and holding quality stocks. Of course, anything is possible over the short term. However, if you create stock seedlings as I discussed in the previous section and simply move on to other plays to create more, that takes advantage of the long-term power of compounding while you remain an active investor. Learn to do nothing.

Take 'Tip' Sites with a Huge Grain of Salt

Incidentally, I am ranked on various 'tip' sites that grade bloggers on the returns generated by the stocks they mention in their articles. I had nothing to do with that, and did not even know that was the case until someone pointed it out and I went looking. I suppose that means I now am a 'public figure' or something. Anyway, I do well on them, but it depends on the market for the income stocks that I write about.

|

| I took this at random on 5 May 2016 - first time I have visited the site in months. Looks like I'm doing pretty well. If income stocks tank, so will my ranking, I suppose. |

I would like to caution you about taking their findings too literally. For instance, one major such site that shall remain nameless and unlinked here gives me a certain score based on (as I write this) about twenty stocks I have written about.

However, I have actually written about more than twice that many stocks (see below) and have made about twice that many recommendations. Some of my articles cover several recommendations, such as

here (3 utility stocks) and

here (5 foreign stocks) and those sites are not equipped to recognize them. Their software looks for certain phrases and words and misses articles that do not fit into what they are looking for. The stocks mentioned in those articles appear on none of the 'tip' rank sites; for whatever reason, they don't even pick up all the plays mentioned in single-stock articles, which you would think would be fairly easy to do, much less the multi-stock ones.

In addition, those sites somehow always include the stocks that don't do well but manage to miss some of the big winners (such as my article in August 2014 about

Hawaiian Electric, which within months was up 50% - but no tip site picks

that one up). I could go to the trouble of trying to keep those sites updated - but really, what is the point beyond sheer ego. It would require constant updates and wrangling with them to no real purpose. I think any interference with those places smacks of (attempted) manipulation. Incidentally, beware anyone who tries to awe you with their ranking on one of those places - it is easy to manipulate the results by emailing them and arguing with them, 'just bringing this to your attention' and so forth. I've seen some authors mention having done this and, quite frankly, was not impressed that this was so important to them.

There are other problems with such sites. For instance, the returns that they calculate for stocks do not include dividends - and for huge swathes of stocks (including the vast majority about which I write), the dividend is pretty much the only reason to own it. Dividends account for 50% of all long-term returns for the S&P 500, so ignoring the effect of dividends is simply wacky. Basically, these sites judge you on what types of stocks you write about in relation to how those stocks are currently doing in the economic cycle. Were I to want to 'game' such rankings, I would just write articles about Apple and be done with it. Like anything else, if you focus on improving some indicator of value, you can usually manage to gin it up - without affecting the quality of your work one iota. Picture placing a lit match underneath a thermometer on a cold day, anyone can do it and it certainly changes the results you derive, but it means nothing beyond creating a false front.

More fundamentally, and all other quibbles aside, they simply are not accurate. They do not update very frequently, so their ratings can be out of date. Every stock that they pick up as being a "recommendation," which isn't always the case, exists there eternally. Thus, if you ever change your mind about a security, that doesn't matter - it will haunt your rankings forevermore.

So, caution is advised when using such sites, they are not accurate at all. Just because someone is ranked highly at some point in time (and I have been at times) or lowly (that happens at times too) really means nothing except as a very general barometer.

My Articles

The below articles are all reviewed by editors and checked for content and form (I receive feedback on content with maybe half of my submissions, rarely regarding form). The articles are not necessarily recent, so check the dates, but even the older ones could be useful for background information. The list also is not complete; instead, it is intended merely to provide a starting point and give a feel for the types of stocks that I write about. I shall be updating this list from time to time, but just follow any of the links and you should be able to find all the other articles.

If you do go to visit Seeking Alpha, be sure to

follow me there and drop me a note. These are in no particular date order or anything like that.

General:

The Case for Reits in 2015

The Hidden Danger of Index Funds (NYSE:SPY)

What is a Quality Stock and When Are They Buys (NYSE:SPY)

The September Jobs Report Does Not Support A Fed Rate Hike (NYSE:SPY)

Why The Fed Is Making Me Nervous (NYSE:NLY)

Monthly Dividend Stocks

My Top 10 Monthly Dividend Stocks (NYSE:O)

My Top 10 Monthly Dividend Stocks: Updated (NYSE:O)

My Top 10 Monthly Dividend Stocks: Updated (NYSE:O)

Monthly Dividend Payers: Your Port In A Storm (NYSE:O)

The Generation Portfolio

The Generation Portfolio (NYSE:SPY)

The Generation Portfolio: Wells Fargo, Disney, MFA Financial, Bristol-Myers Squibb (NYSE:WFC)

The Generation Portfolio: Coke, Wal-Mart, Ventas, Kinder Morgan, Medical Properties Trust (NYSE:KO)

The Generation Portfolio: W.P. Carey, AT&T, Verizon And 3M Company (NYSE:WPC)

The Generation Portfolio: Main Street Capital And Williams Companies (NYSE:MAIN)

The Generation Portfolio: Pfizer (NYSE:PFE)

The Generation Portfolio: Reinvesting (NYSE:ABR)

The Generation Portfolio: Rate Fears Consume The Market (NYSE:HSY)

The Generation Portfolio: Six Month Update (NYSE:LXP)

Generation Portfolio: Wish List (NYSE:AAPL)

REITs:

Urstadt Biddle (NYSE:UBA)

Gladstone Commercial (NASDAQ:GOOD)

Acadia Realty (NYSE:AKR)

American Assets Trust (NYSE:AAT)

Lexington Realty Trust I (NYSE:LXP)

Lexington Realty Trust II (NYSE:LXP)

Chambers Street (NYSE: CSG),

Columbia Property Trust (NYSE:CXP)

Hannon Armstrong I (NYSE:HASI)

Hannon Armstrong II (NYSE:HASI)

American Realty Capital Properties (NYSE:VEr) (December 2014)

American Realty Capital Properties (NYSE:VER) (January 2015)

American Realty Capital Properties (NYSE:VEr) (February 2015)

HCA Holdings (NYSE:HCA) (Part 1)

National Retail Properties: Dips Are Buying Opportunities (NYSE:NNN)

A Projected Holiday Sales Jump Could Be Jolly For National Retail Properties (NYSE:NNN)

Liberty Property Trust (NYSE:LPT)

Government Properties Income Trust (NYSE:GOV)

Senior Housing Properties Trust (NYSE:SNH)

Sunstone Hotels (NYSE:SHO)

Whitestone REIT I (NYSE:WSR)

Whitestone REIT II (NYSE:WSR)

UMH Properties (NYSE:UMH)

OHI Healthcare I (NYSE:OHI)

OHI Healthcare II (NYSE:OHI)

Stag Industrial I (NYSE:STAG)

Stag Industrial II (NYSE:STAG)

Washington REIT (NYSE:WRE)

Arbor Realty Trust I (NYSE:ABR)

Arbor Realty Trust II (NYSE:ABR)

REITs and You: An Introduction, With Some Tips (NYSE:MORL)

My Top 3 Mortgage REIT Picks (NYSE:CYS)

3 Key Takeaways From CYS Investments' Conference Call (NYSE:CYS)

Annaly Capital Management and the New Fed Paradigm (NYSE:NLY)

W.P. Carey (NYSE:WPC)

W.P. Carey II (NYSE:WPC)

Chatham Lodging Trust (NYSE:CLDT)

New York REIT (NYSE:NYRT)

Ashford Hospitality Trust (NYSE:AHT)

Starwood Property Trust Needs To Step It Up (NYSE:STWD)

Is Starwood Property Trust Bottoming? (NYSE:STWD)

Why REITs Emphasizing Sustainability Can Make You Money (NYSE:GGP)

CareTrust REIT: Lots Of Value In This Reliable Dividend Payer (NYSE:CTRE)

10% Yield, Good Earnings, What's Not To Love About This REIT? (NYSE:SIR)

BDCs

ETF/ETN Analysis

REIT ETF/ETN Showdown: REM Vs. MORL (NYSE:MORL)

ETN Showdown: MORL Correlations And Strategies (NYSE:MORL)

ETN Showdown: Is MORL Overvalued? (NYSE:MORL)

ETN Showdown: BDCL Vs. MORL (NYSE:BDCL)

ETN Showdown: SMHD Adds Diversification And Yield (NYSE:SMHD)

ETN Showdown: Are MORL - And All mREITs - Doomed By Rising Rates? (NYSE:MORL)

ETN Showdown: MLPL, A Great Play For An Oil Rebound (NYSE:MLPL)

AMZA: An Insider's Look At The MLP Sector (NYSE:AMZA)

ETN Showdown: Why Now Is The Time To Consider MORL (NYSE:MORL)

Why I Like High Yield ETFs And ETNs (NYSE:MORL)

Why Annaly Capital's Earnings Report Was Positive For MORL And REM (NYSE:MORL)

ETN Showdown: Fed Chair Janet Yellen To MORL's Rescue (NYSE:MORL)

ETN Showdown: MORL Correlations And Strategies II, Financial Stocks (NYSE:MORL)

PFF: Why I Own This Preferred Shares ETF (NYSE:PFF)

5 Top Floating Rate Funds (NYSE:FRA)

Utilities:

Hawaiian Electric (NYSE:HE)

NextEra Energy (NYSE:NEE)

Exelon Corp. (NYSE:EXC)

Pinnacle West Capital (NYSE:PNW)

FirstEnergy Corp (NYSE:FE)

3 Utility Stocks For Today (NYSE:DUK)

3 Utility Stocks to Consider Now (NYSE:ED)

Why REITs Emphasizing Sustainability Can Make You Money (NYSE:GGP)

Entertainment Companies:

DreamWorks Animation (NYSE:DWA) (July 2014)

DreamWorks Animation (NYSE:DWA) (December 2014)

DreamWorks Animation (NYSE:DWA) (November 2015)

Disney Is A Buy On Dips (NYSE:DIS) (August 2014)

Why I Still Like Disney (NYSE:DIS) (October 2015)

IMAX (NYSE:IMAX) (August 2014)

IMAX (NYSE:IMAX) (January 2015)

Lion's Gate (NYSE:LGF)

Retail

Home Depot (NYSE:HD)

Best Buy (NYSE:BBY)

Best Buy II (NYSE:BBY)

Walgreen (NYSE:WAG)

Big Lots Could Cause Big Pain To Shorts (NYSE:BIG)

Target Is Not Wal-Mart And Is Good Value (NYSE:TGT)

Technology

Analog Devices (NYSE:ADI)

Brocade (NASDAQ:BRCD)

Praxair (NYSE:PX)

Borg Warner (NYSE:BWA)

International Flavors & Fragrances (NYSE:IFF)

Cypress Semiconductor Looks Ready For A Rebound (NASDAQ:CY)

Energy

Dominion Midstream Partners - Insiders Think It's A Bargain (NYSE:DM)

Health Care

Wellpoint Inc. (NYSE:WLP)

Pfizer (NYSE:PFE)

Miscellaneous

Western Union (NYSE:WU)

Western Union II (NYSE:WU)

Cracker Barrel (NYSE:CBRL)

Sotheby's (NYSE:BID)

Sotheby's II (NYSE:BID)

Dividend Quick Picks: Foreign Stocks (NYSE:SAN)

|

| 22 March 2015 |

2015